|

|||

|---|---|---|---|

|

|

|

|---|---|---|

|

||

|

|

|

|

|---|---|---|

|

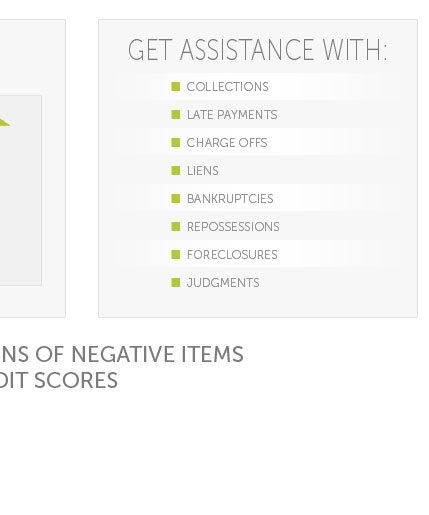

Unlock your financial potential with our revolutionary credit repair services-your gateway to transforming your credit score from a barrier into a stepping stone towards the life you've always dreamed of; with our expert guidance and personalized strategies, fixing your credit score is not just a possibility but a promise, as we meticulously navigate the complexities of credit restoration to elevate your financial standing and empower you with the knowledge and tools to maintain your newfound financial freedom-because you deserve more than just a number, you deserve a future.

https://www.lssmn.org/financialcounseling/financial-wellness-services/credit-improvement

Key Strategies to Maintain and Improve Credit Scores - Pay bills on time and before the due dates with at least minimum payments requested on billing statements.

Key Strategies to Maintain and Improve Credit Scores - Pay bills on time and before the due dates with at least minimum payments requested on billing statements.

https://www.equifax.com.au/personal/what-credit-repair

Credit repair is the act of restoring or correcting a poor credit score. It can also involve paying a company to contact the credit bureau ...

Credit repair is the act of restoring or correcting a poor credit score. It can also involve paying a company to contact the credit bureau ...

https://www.lendingtree.com/credit-repair/how-to-improve-your-credit-score/

How to improve your credit score - 1. Check your credit report for errors - 2. Prioritize paying on time - 3. Work to pay down your debts - 4.

How to improve your credit score - 1. Check your credit report for errors - 2. Prioritize paying on time - 3. Work to pay down your debts - 4.